How learning maths can help with your mortgage

27 January 2023

The more that students study maths to a higher level, the better for them and for society, and no financial literacy course can replace understanding the fundamental mathematical concepts, writes Melissa Tacy.

Opinion: The announcement by British Prime Minister Rishi Sunak of a plan to boost the mathematical capacity of their high school graduates by making maths compulsory up to the age of 18 has generated a significant amount of media attention. It is alarming to hear commentators and people on social media claim that higher mathematics is not relevant to our daily lives.

Instead, they advocate that “what we really need is to teach a basic financial literacy course” and that because they personally don’t use maths beyond basic numeracy, “it’s irrelevant unless you want a technical career”.

Maths provides people with the skills that can be valuable in many real-life contexts, for example, managing a mortgage in a time of uncertain interest rates.

It’s estimated that nearly half of New Zealand’s mortgage holders will need to re-fix their home loans within the next six months. I’m one of them, so I’ve been spending a fair bit of time working out my best option. It’s quite likely I have a significant advantage over the majority of similarly situated homeowners because I happen to be highly numerate.

This doesn’t give me a crystal ball to determine what the Reserve Bank will do with interest rates, but it does give me the ability to model various possibilities and accurately determine where I would stand if any of these came to pass.

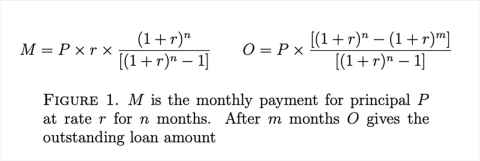

Above you see two formulae. To many people these equations may look like a jumble of letters, or hieroglyphics, but they make sense to me.

The first formula takes as inputs a person’s loan principal, the interest rate and the term of their loan. It then calculates their monthly payment. The second formula tells you what your outstanding balance will be on your loan at any moment in time.

What I see is a formula that is made up of “old friends” which provide me with much of the information I want without needing a computer or calculator. Just by examining them, I can roughly tell you what these formulae would look like if they were graphed and what the implications would be.

If I need further detail (for instance, what if I managed to make an extra $2000 repayment seven months in?), I can easily put together a spreadsheet that will allow me to see exactly what would happen to my mortgage. I can adjust and personalise the parameters as much as I want to. In an uncertain environment my mathematical abilities allow me to take back a little power. I can’t predict the future rates but, working with different predictions or ‘guesstimates’, I can see exactly what different scenarios would mean for me.

I’m a maths lecturer so you might expect me to be comfortable with mathematical calculations but I’m not using anything that I didn’t learn in high school.

When I said I could predict what the formulae in Figure 1 would look like graphed I was using a technique called curve sketching. This is a basic concept taught in introductory calculus. I use such techniques, along with a whole suite of others again when I check my detailed spreadsheet for errors. (I’m typo-prone so I always sanity check my mathematics.)

No financial literacy course can replace understanding the fundamental mathematical concepts. Without the underlying concepts students can only learn by rote.

I use my problem solving and logistical planning skills when I need to organise my personal finances, and also to manage many other parts of my life, such as holiday planning or a house move. I use my geometrical reasoning and trigonometry to work out optimal ways of laying out furniture in my apartment and, crucially, whether individual pieces will be able to be moved around corners, into corridors and lifts. Over the past three years I’ve often leant on my mathematical knowledge to process the data flooding the media about the Covid pandemic and to understand the epidemiological models and their predictions.

A student who takes maths up to the end of high school will have the skills to do everything I have mentioned above, and more.

It is true those people who never learn a subject never use it, which is a huge loss when it comes to not learning maths. No financial literacy course can replace understanding the fundamental mathematical concepts. Without the underlying concepts students can only learn by rote and are unlikely to be able to recall that information 10-20 years later when they come to need it. In contrast someone who has mastered the fundamentals can easily pick up details at the time they need them.

Maths, as a subject, has the advantage of being self-reinforcing. When you first learn trigonometry, for example, you need to brush up on your basic algebra and geometrical reasoning. When you take calculus you practise your trigonometry, algebra and geometrical reasoning again. Most people find it hard to learn anything comprehensively the first time they see it, but by taking maths for longer you not only gain a higher level of knowledge but also you reinforce your previous skills, making them more likely to stay with you lifelong.

We will have our own debates about which level of maths should be taught in our schools and for how long. When we do, we need to remember that while maths is frequently hard work it teaches invaluable skills that can used to navigate and plan for myriad aspects of life.

Dr Melissa Tacy is a lecturer in Mathematics, Faculty of Science, and President of the New Zealand Mathematical Society.

This article reflects the opinion of the author and not necessarily the views of Waipapa Taumata Rau University of Auckland.

This article was first published on Newsroom, How higher maths can help with your mortgage, 26 January, 2023.

Media contact

Margo White I Media adviser

Mob 021 926 408

Email margo.white@auckland.ac.nz